How to Enroll in Coverage or Change Your Existing Coverage

Step 1: Visit our custom SPU life insurance Decision Support Tool: coming soon

Step 2: Review the plan summaries and other information included on the site

Step 3: Select the green "Continue to Enrollment" button on the site to bring up the form

Step 4: Complete the form and return it to SPU Human Resources

How Much Additional Life Insurance Coverage Can I Apply For?

| Additional Voluntary Term Life and AD&D Insurance | |

|---|---|

| Employee | May be purchased in $10,000 increments up to $500,000 - medical underwriting (health statement) required if over Guaranteed Issue. Guaranteed Issue limit of $150,000 is allowed during this special Open Enrollment period with no health statement required.-The Standard Guaranteed Issue limit of $200,000 is allowed during this special Open Enrollment period with no health statement required.-Colonial Life |

| Spouse* | May be purchased in $5,000 increments. May not exceed the amount of the employee's additional voluntary amounts and limited to $250,000. Guaranteed Issue limit of $25,000 is allowed during this special Open Enrollment period with no health statement required. |

| Dependent Child(ren)* | May be purchased in $1,000 increments up to a maximum of $10,000. May not exceed the amount of the employee's additional voluntary amounts. Children are eligible to be covered through age 25. For this coverage, the entire $10,000 benefit is always Guaranteed Issue with no health statement required. |

| Voluntary AD&D is also available to you in the same coverage amounts as life insurance. | |

*PLEASE NOTE: In order to purchase voluntary term life and AD&D coverage for your dependents, you must purchase coverage for yourself. Premiums are paid entirely by the employee through payroll deductions on an after-tax basis.

What Is Guaranteed Issue Coverage?

When considering life insurance coverage, you sometimes have a Guaranteed Issue amount offered. Guaranteed Issue amounts are the level of insurance benefit that an otherwise eligible individual is allowed to purchase with no health questions being asked. This could be very important for someone with a pre-existing medical condition. Life insurance plans almost always want to know of anyone with a serious medical condition before offering them coverage. Sometimes, a condition is serious enough that no coverage will be offered when health underwriting is applied, other times the insurance company may approve a part of the applied for amount of coverage.

Eligible employees may begin Voluntary Life and AD&D coverage any month on a go-forward basis... but health underwriting normally always applied as a part of the application process before the coverage is approved. But, there are times when Guaranteed Issue coverage is available. One such time is the first 31 days of employment of a newly eligible employee.

Guaranteed Issue Amounts Available to Newly Eligible Employees - The Standard (through December 31, 2023)

Employee Life and/or AD&D Coverage: up to $150,000

Spouse Life and/or AD&D Coverage: up to $25,000

Child(ren) Life and/or AD&D Coverage: up to $10,000

Guaranteed Issue Amounts Available to Newly Eligible Employees - Colonial Life (effective 1/1/2024)

Employee Life and/or AD&D Coverage: up to $200,000

Spouse Life and/or AD&D Coverage: up to $25,000

Child(ren) Life and/or AD&D Coverage: up to $10,000

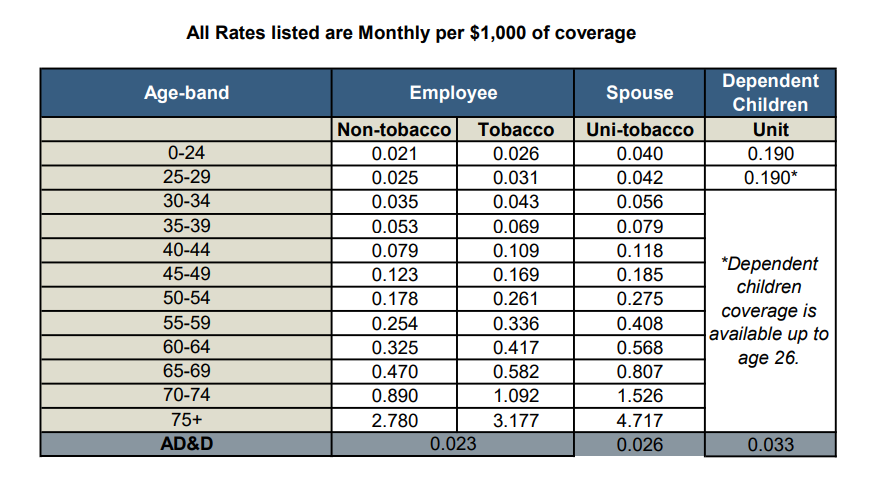

How Much Does Voluntary Life Insurance Cost?

The University provides basic term life insurance coverage in the amount two times annual earnings for all benefit-eligible employees (those at half-time employment, 0.50 FTE, and above). This coverage does include matching AD&D provisions as well. But many employees find their personal insurance needs go beyond these coverage amounts. That is why Voluntary Life and Voluntary AD&D insurance plans are offered. Eligible SPU employees and their families can obtain more insurance coverage at group rates. For those employees that are not newly eligible, health underwriting does apply. However, this involves only a limited set of health questions rather than physical exams, which is often the case with life insurance plans that are purchased on the individual market.

Here is to calculate the insurance premiums for these coverages:

Employee and Spouse Coverage: each increment of $1,000 costs $________ per month. Use the table below to find your specific rate based on age as of January 1, 2020.

For example, assume a 40 year old SPU Employee is purchasing $150,000. That would be 150 units at $0.126 per, equaling $18.90 in premium due per month.

Further, to cover this same employee's 42 year old spouse for $50,000 of coverage would be 50 units at $0.202 per, equaling $10.10 per month.

Child(ren) Coverage: each increment of $2,000 costs $0.46 per month (and includes the purchased coverage for all your eligible children for the one premium).

For example, assume a 40 year old employee is wanting to cover her five children at $10,000 each. That is 5 units at $0.46, equaling $2.30 per month. So for a total of $2.30 per month, each of her five children are covered with $10,000 of coverage.

The Standard

Age (as of January 1) | Your Rate (per $1,000 of Total Coverage) | Your Spouse's Rate (per $1,000 of Total Coverage) |

|---|---|---|

| < 30 | $0.067 | $0.098 |

| 30 - 34 | $0.069 | $0.102 |

| 35 - 39 | $0.091 | $0.142 |

| 40 - 44 | $0.126 | $0.202 |

| 45 - 49 | $0.200 | $0.314 |

| 50 - 54 | $0.308 | $0.494 |

| 55 - 59 | $0.506 | $0.745 |

| 60 - 64 | $0.765 | $1.308 |

| 65 - 69 | $1.330 | $2.216 |

| 70 - 74 | $2.371 | $3.902 |

| 75 + | $4.771 | $7.400 |

Colonial Life

Benefit Reduction Due to Age

When an employee turns 70, coverage reduces to 65% of the face amount in effect just prior to age 70.

When an employee turns 75, coverage reduces to 50% of the face amount in effect just prior to age 70.

Policies issued to individuals over age 70 initially are automatically reduced in accordance with the schedule above.

Spouses experience the same reduction schedule, but it is based on the spouse's age.

Premiums

Employee and spouse initial premiums are based on current age and will change as the insureds age, based on five-year age bands.

Dependent children premiums are based on the cost of coverage for one child, regardless of the number of children insured.

Accidental Death and Dismemberment (AD&D) - Available at the same face amount of Life coverage. Will be provided for all covered persons (employee, spouse and dependent children) receiving Life coverage. Must have Life coverage to receive AD&D coverage.

*PLEASE NOTE: The attachments to this page include complete rate tables showing the monthly premium amounts based on age for each type of coverage. Premiums are paid entirely by the employee through payroll deductions on an after-tax basis. To be covered, all employees must be actively at work (able to perform all normal duties of your job) on the day before the insurance is scheduled to be effective. Coverage amounts for ages 70 and over reduce due to age reduction tables.

How Much Does Voluntary AD&D Insurance Cost?

Here is how to calculate the monthly insurance premiums for SPU's Voluntary AD&D coverage through The Standard:

AD&D Coverage: each increment of $1,000 costs $________ per month. Use the table below to find your specific rate based on age as of January 1, 2020.

For example, assume a 40 year old SPU Employee is purchasing $150,000. That would be 150 units at $0.025, equaling $3.75 in premium per month.

| Coverage For... | Cost per $1,000 of Coverage |

|---|---|

| You (employee) | $0.025 |

| Your spouse | $0.030 |

| Your children (regardless of how many) | $0.030 |

To Cancel Your Coverage

Voluntary Life and AD&D Insurance May be Cancelled Any Month

If you would like to cancel your coverage amount, or the coverage of a dependent, this can be done at any time and will be effective on the first of the month following the submission of your completed change form to SPU Human Resources. Please note that if you want to re-enroll in coverage in the future, or increase coverage, you will be subject to health underwriting and may not qualify for the coverage you apply for or once had.

For More Information

For access to the plan summaries and other helpful information, please see the Standard Insurance Online Decision Support Tool: HERE

To cancel your coverage, please see the SPU Voluntary Life/AD&D Change/Cancellation Form: HERE

To maintain the security of your personal information, we recommend that you use the HR Digital Dropbox to submit your form.

Important Reminders & Resources

To obtain this coverage, you must proactively enroll and be approved for coverage by The Standard.

Voluntary Life and AD&D Insurance Premiums in 2021 Will Match Current 2020 Rates

The new plans as of January 1, 2020 were negotiated with a multi-year rate guarantee, matching prior coverage rates/premiums, with only a few exceptions where the cost actually became lower than before. Voluntary coverage like this is paid for entirely with employee dollars on an after-tax basis. Group rates for this kind of coverage are usually better than what is available on the individual market..

Current Voluntary Life and AD&D Insurance Coverage Amounts Will Roll Forward

If you maintain SPU Voluntary Life and/or Voluntary AD&D coverage, your current amount of coverage will automatically be rolled over to future plan years unless you decide to change your coverage. All changes must be made on a go-forward basis.

For More Information

For detailed plan information on the benefits and changes coming, please visit the HR Wiki Page and review the Employee Benefits Handbook. As always, hardcopies of the benefits materials are available upon request. Pleace contact Human Resources at (206) 281- 2809 or email hr@spu.edu.